The contract term is 3 years. It is a 2-year guarantee base salary plus productivity. If you exceed your guarantee base salary in the first year of employment, you would receive a prodcutivity bonus and transition to the productivity model. While on your guarantee, a certain number of call shifts are embedded as part of your guarantee. For example, you may have 30 call shifts required as part of your guarantee, but it is anticipated that you would take 60 call shifts per year. So the 30 additional call shifts would be paid directly to you. Once off your guarantee, call is paid out 100% starting on your first shift, directly to you. Call is paid at $1,200 per shift. A shift is considered 1 call day.

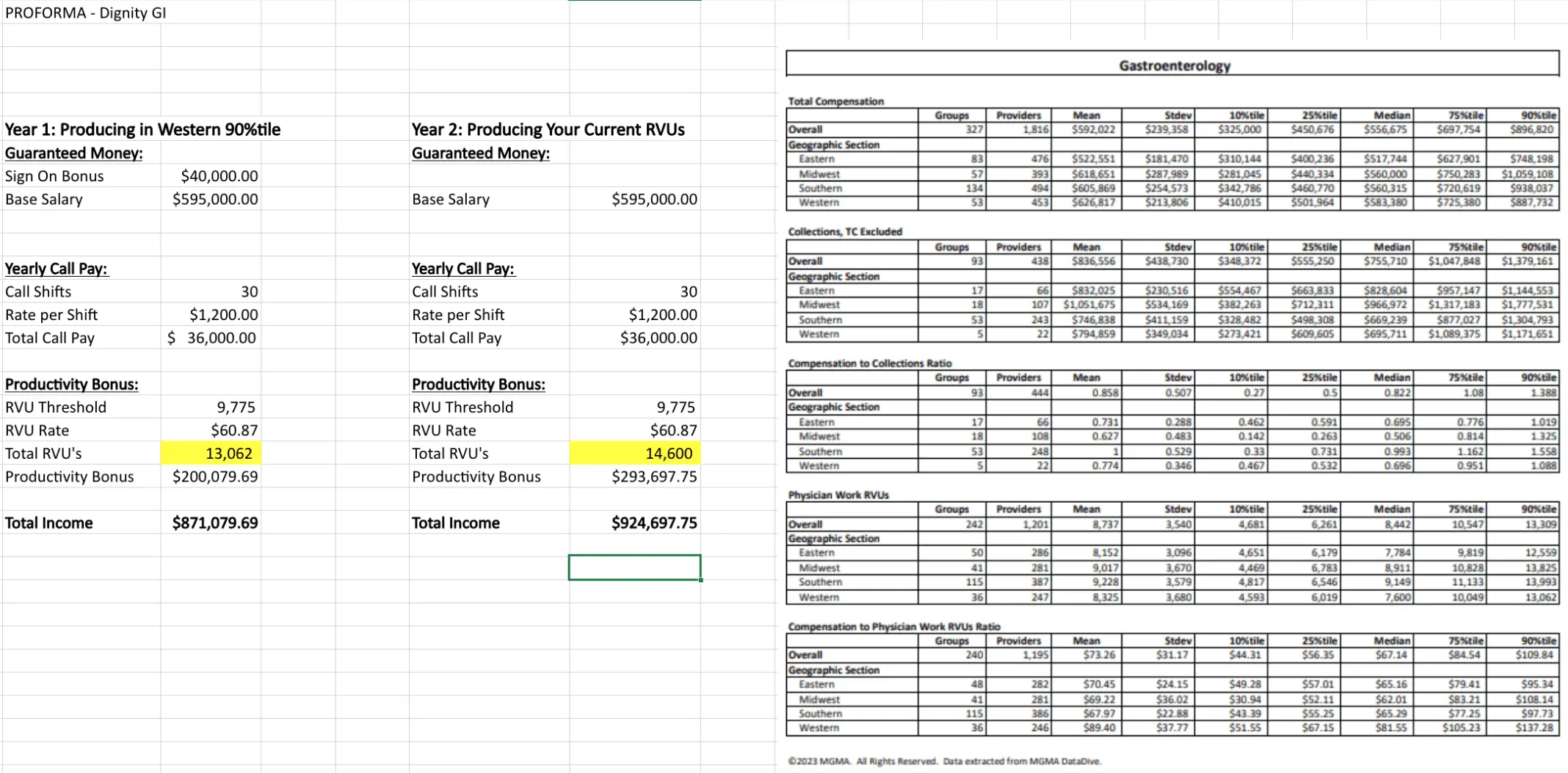

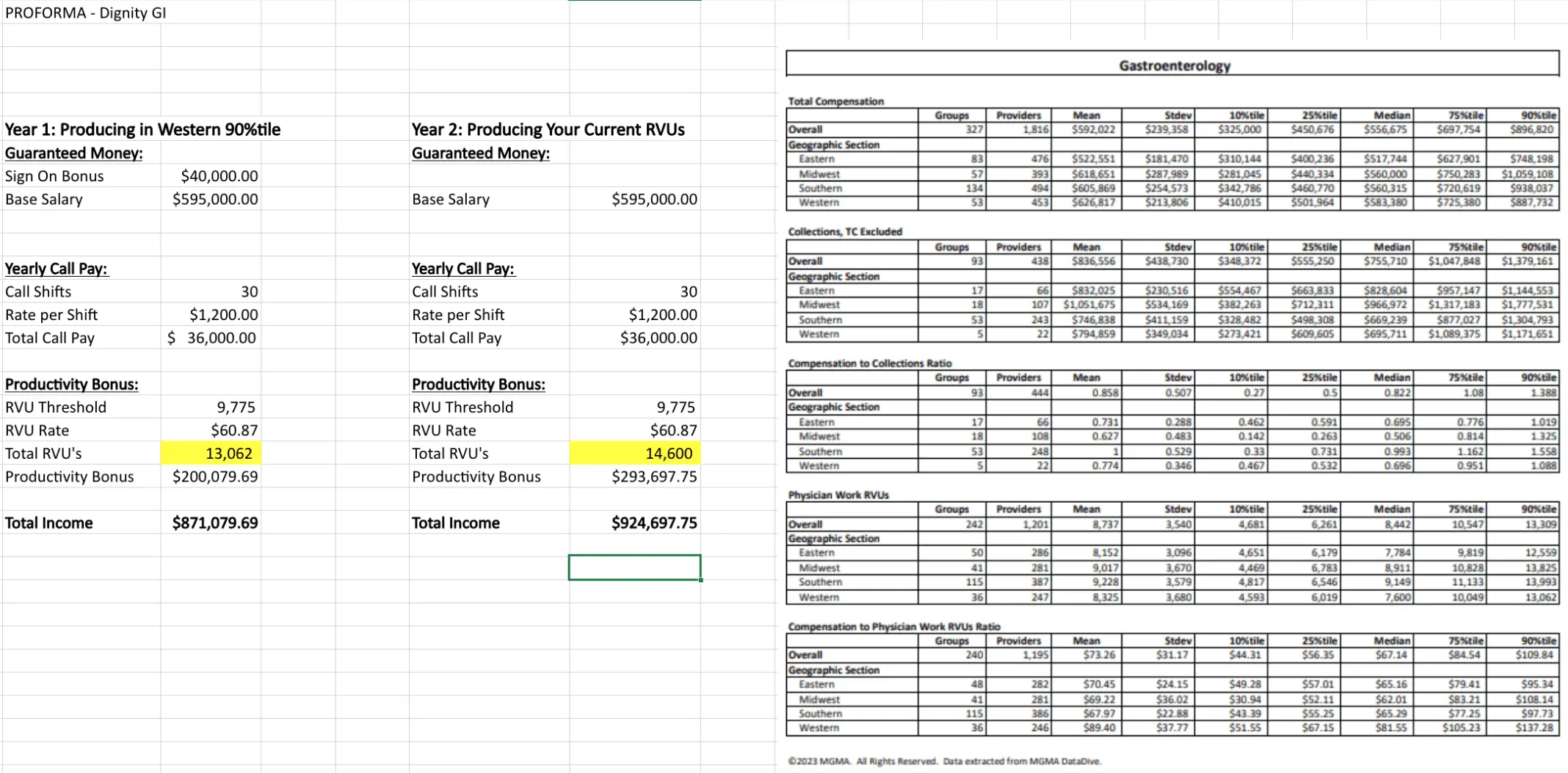

The guarantee base salary range for this position is $575,000 - $600,000 depending on experience. The RVU rate is $60.87, which has consistently increased each year to account for changes in the market, inflation etc. They offer a sign on bonus of $40,000. This sign on bonus is paid in full on your first paycheck following your first shift. Dignity utilizes a biweekly pay schedule. They also offer up to $20,000 of relocation assistance and have a team that would work with you to assist with any moving expenses, coordination etc. Below is an example of what your income potential would be as part of the team in Stockton with 2023 MGMA data for reference.

Dignity health has a comprehensive benefits package that will be provided to you with your offer of employment. Coverage begins on the first of the month coinciding with or following your first day of employment. All elections are in effect for the entire plan year. There are four Blue Shield of California plans for you to choose from: two HMO plans with a full or limited HMO network, a traditional PPO plan (in-network and out-of-network coverage) and an HAS compatible high deductible PPO plan (in-network and out-of-network coverage).

If eligible, they also have a HealthEquity Health Savings Account (HSA) that you can contribute to. An HAS is a tax-sheltered bank account that you own to pay for eligible health care expenses for you and your eligible dependents for current or future healthcare expenses. The HAS is yours to keep, even if you change jobs or medical plans. There is no “use it or lose it” rule, the balance carries over year to year. Plus, you get extra tax advantages with an HAS because the money you deposit is exempt from federal income taxes. You do not pay income taxes on withdrawals used to pay for your eligible health expenses. You also have a choice of investment options which earn competitive interest rates, so your unused funds grow over time.

Foundations Physicians Medical Group also provides dental benefits. They have a PPO plan so you may receive dental care from the licensed dentist of your choice. You will receive the highest level of benefits if you select an in-network dentist who has agreed to provide services. If you use an out-of-network dentist, they may bill you the difference between what the dental insurance pays and the dentist charges.

Vision Benefits are included as well, you can select from 2 options for vision coverage.

Foundations Physicians Medical Group also provides Basic Life and AD&D benefits to eligible employees. Life insurance protects you and your designated beneficiaries from financial hardship in event of death. Accidental Death & Dismemberment (AD&D) insurance provides additional protection to your designated beneficiaries in the event of your death or provides a lump sum benefit to you in the event of loss of limb, eyesight or hearing.

In addition to the employer paid Basic Life and AD&D coverage, you will have the option to purchase additional voluntary life insurance to cover any gaps in your existing coverage that may result of age reduction schedules, cost of living, existing financial obligations, etc.

Foundation Physicians Medical Group provides 401(k) with match through Fidelity. After you complete 1 year of service, Foundation Physicians Medical Group contributes a company match and an annual non-elective contribution to your account. You can contribute from 1% to 80% of your eligible compensation up to the current IRS contribution limit. The company matches 50% on the first 6% of eligible pay that you defer to your plan.

In addition to the match, the medical group makes an annual employer contribution to the plan. The amount of the non-elective contribution increases as you age. For example physicians aged 35-44 would receive a 4% non-elective contribution to their 401(k) in addition to their match. This increases as you age, a physician 55-59 years old would receive a 7% contribution to their retirement plan.

The group has contracted with Retirement Benefits Group to support physicians regarding saving for retirement and or personalized financial assistance if you have any questions.

We have options for student loan repayment, depending on the needs of the physician at the time of accepting an offer of employment with us. Specifics including payment schedules and amounts will be detailed with your offer.